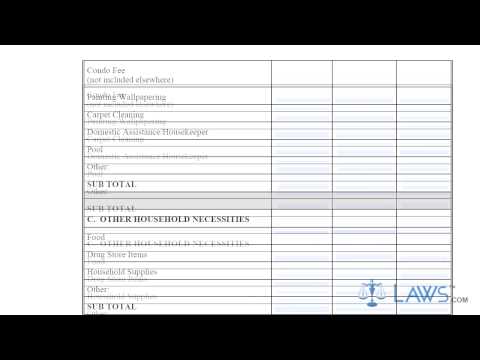

Laws calm legal forms guide Maryland financial statement form DR-31. In a divorce involving children in Maryland, where alimony, child support, attorneys fees, and other finance-related issues are involved in the separation, both parties may have to complete a long-form Maryland financial statement. This document can be downloaded from the website maintained by the Maryland Judiciary. - Step 1: At the top of the page, indicate the location of the court hearing your case and the number of side prthe full name and address of both spouses. - Step 2: Enter the name of the person completing this form and the names and ages of all children involved in the marriage. - Step 3: The first six pages of this form concern your monthly expenses. Enter the expenses of you and any children in separate columns, then list the totals. - Step 4: Sections A through C require you to detail all expenses related to your residence, including mortgage payments, utility and maintenance bills, and necessary purchases such as food. - Step 5: Section D requires you to list all medical expenses. - Step 6: Section E requires you to list all education costs. - Step 7: Section F concerns costs related to entertainment. - Step 8: Section G concerns transportation costs. - Step 9: Section H concerns gifts, including donations to charity. - Step 10: Section J concerns clothing costs, including cleaning expenses. - Step 11: Sections K and L concern other miscellaneous expenses. - Step 12: Page 7 is an income statement. Enter all information requested about your wages, including how much is withheld to pay state and federal taxes. Include all income from all sources. - Step 13: Page 8 requires you to list all of your assets and debts. You will then be able to calculate...

Award-winning PDF software

Financial disclosure affidavit ny Form: What You Should Know

It's a public document which is legally binding. You can get a copy of the form from the New York City Department of Financial Services. 1. Fill out the Financial Disclosure Affidavit Form. The statement you use is important. 2. Tell me how much money you made in the last 12-month pay period: the gross income or net income. 3. What was your gross income. What was your net income? 4. What was your total gross income: your gross wages or your gross commissions, your earnings or your pay of 200 or more, your annual gross income, or the gross income of 5,000 or more, if single? (NOTE: Gross income means your total income, including your gross wages.) 5. What was your gross expenses? a. Net or net income for the 12-month period beginning January 1, 2016: Your last 12-month gross earnings (gross cash earnings from all sources) — Your last 12-month gross commissions (gross fees paid to business or professional organizations) — Your last 12-month total wages (gross net earnings from all sources) — Your last 12-month total commissions (gross fees paid to business or professional organizations) — Your last year total income (5,000 – 50,000) plus your total commissions 60 – 100 — (If you are married filing jointly or married filing separately, total gross income for this amount) b. Gross income for the 12-month period beginning January 1, 2013: Your gross income (revenues, fewer expenses), minus what you paid in child support as determined in the order of support, your child support obligations, and your spouse's child support obligations. c. Gross income for 2025 and 2013: the last 12-month gross income (revenues, fewer expenses) which equals your Gross Annual Income (GAME): 5,000 – 50,000, plus your child support obligations (as determined in the order of support) — your spouse's child support obligations (as determined in the order of support) — any child support paid during the year f. Add your gross expenses g. How did you pay your expenses? 3. What was your net expense for 2025 and 2013: a.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do WI Fa-4139V, steer clear of blunders along with furnish it in a timely manner:

How to complete any WI Fa-4139V online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your WI Fa-4139V by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your WI Fa-4139V from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Financial disclosure affidavit ny form